Your Home's Equity, Reimagined (NMLS #7861)

Pay less interest and keep more cash each month with a Vision One HELOC

Apply in 5 minutes

Funding in 5 days

Unlock your home's potential with a modern, fast, and flexible way to access your equity. Get the funds you need with the predictability you deserve.

Apply with our 100% online application in minutes

with funding in as few as 5 days.

Why Choose a HELOC

with Vision One?

Unlock your home's potential with a modern, fast, and flexible way to access your equity. Get the funds you need with the predictability you deserve.

Fixed-Rate Security

Unlike traditional HELOCs, every draw comes with a fixed interest rate for predictable, stable payments.

Fast & Digital

Apply online in minutes, skip the in-person appraisal, and get funded in as little as 5 days.

Flexible Loan Amounts

Access from $15,000 up to $400,000 with terms of 5, 10, 15, or 30 years to fit your needs.

Redraw Flexibility

Borrow the full approved amount upfront, then redraw funds as you pay down your balance.

Smart Technology

Our automated valuation model makes the process seamless, paperless, and stress-free.

No Prepayment Penalties

Pay off your balance ahead of schedule without incurring additional fees or early closure penalties.

Our Simple 3-Phase Process

1 Initial Draw

Once approved, you’ll receive 100% of the loan amount upfront, minus any origination fees. This gives you immediate access to your funds.

2 Draw & Repayment

Once approved, you’ll receive 100% of the loan amount upfront, minus any origination fees. This gives you immediate access to your funds.

3 Final Repayment

Once approved, you’ll receive 100% of the loan amount upfront, minus any origination fees. This gives you immediate access to your funds.

The #1 Non-Bank Home Equity Line of Credit in the U.S.

No need to wait for an in-person appraisal. Faster than a bank loan, cheaper than a personal loan. Get the funds you need now, and move forward with life.

$17B

In Equity Unlocked with Figure’s Platform

We've helped homeowners access billions in home equity, providing fast solutions for their financial needs.

201K+

Households Served with Figure’s Platform

Trusted by over 200,000 households to unlock their home’s equity with ease and speed.

100%

Online Application Process

Skip the paperwork with our fully digital, seamless application process—apply from the comfort of your home.

How Vision One’s HELOC Compares to Other Loan Options

Explore the differences in speed, flexibility, and cost. See why Vision One’s fixed-rate HELOC with fast funding and a 100% online process can be a smarter choice than traditional bank HELOCs or personal loans.

| Feature | Vision One HELOC | Traditional Bank HELOC | Average Personal Loan |

|---|---|---|---|

| Application | 100% online, see your rate instantly | Varies by lender, may require in-person processes | Varies by lender |

| Payment Penalty | Never | Possible, varies by lender | Possible |

| Tax Deductible | For home improvement (consult a tax professional) | For home improvement (consult a tax professional) | Not tax deductible |

| Funding Speed | Funding in as few as 5 days on loans of $400K or less | Could be weeks | Varies, generally quick |

| Average APR | Competitive rates | Variable rates, potentially higher | Typically higher than HELOCs |

Who Qualifies?

Our goal is to make home equity accessible. Here are the general guidelines for approval:

Minimum Credit Score: Scores starting at 640, with 720+ advised for the best rates.

Maximum Loan-to-Value (LTV): Up to 85% of your home's value.

Maximum Debt-to-Income (DTI): Up to 50%.

Eligible Properties: Single-family residences, townhomes, planned urban developments, and most condos.

State Availability: Available in most U.S. states. Contact us for specifics.

✅ The Upsides

Lightning-fast approvals & funding.

Fixed rates mean no payment surprises.

A fully digital and paperless experience.

Flexibility to redraw funds when you need them.

⚠️ Things to Consider

An upfront draw is required upon approval.

An origination fee (up to 4.99%) may apply.

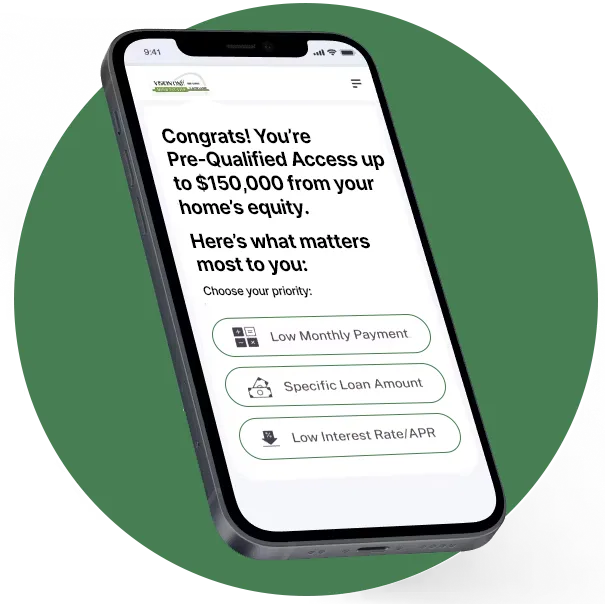

Get Your AI-Powered HELOC Scenario

Curious how a HELOC could work for you? Fill out the form below to get a personalized analysis and creative ideas for your project, powered by AI.

🔑 The Bottom Line

With Vision One Mortgage, you get a modern, fast, and flexible way to use your home equity. It's the perfect solution if you need funds right away for renovations, debt consolidation, or major life expenses—while still keeping the flexibility to tap back into your equity as you pay it down.

Frequently Asked Questions

Find everything you need to know about Vision One’s HELOC program, eligibility requirements, and application process below.

What is a HELOC, and how does it work?

A Home Equity Line of Credit (HELOC) lets you borrow against the equity in your home. With Vision One Mortgage, you can access funds up to $400,000 with flexible repayment terms. You only pay interest on the amount you borrow, and you can redraw funds as you repay your balance.

How Does a HELOC Work and What Are the Qualification Requirements?

You can borrow $15,000 to $400,000, depending on your home's equity. To qualify, you need:

• Credit Score: Minimum 640 (720+ for best rates)

• Loan-to-Value (LTV): Up to 85%

• Debt-to-Income (DTI): Up to 50%

How quickly can I get the funds?

Once approved, you can get your funds in as little as 5 days. The application process is fully online and quick!

Are there any fees?

An origination fee of up to 4.99% may apply. You won’t face any prepayment penalties, and early payoff is allowed without additional fees.

How do I apply for a HELOC?

Simply apply online through our website. The process takes just a few minutes, and you’ll receive an initial decision quickly, with funds available as soon as 5 days.

Your Vision, Your Home, Our Commitment.

© 2025 Vision One Mortgage. All Rights Reserved. NMLS #7861.

Equal Housing Lender

The information provided on this website is for informational purposes only and does not constitute an offer to lend or a commitment to enter into a loan agreement. All loan applications are subject to credit and property approval. Rates, program terms, and conditions are subject to change without notice. Not all products are available in all states or for all loan amounts. Other restrictions and limitations may apply.